As you know, I am all about the gloom and doom when it comes to our capital markets; but since I am in the midst of changing up my portfolio to ride out the coming storm, I thought that I would recommend some solutions for once!

Please note, I have no financial interest in the following products, and as always, PLEASE CONTACT YOUR INVESTMENT ADVISER BEFORE MAKING ANY DECISIONS.

THESE INVESTMENT VEHICLES ARE RISKY, AND YOU CAN LOSE MONEY.

Courtesy of Seeking Alpha:

How to Play the Dollar's Fall With ETFs

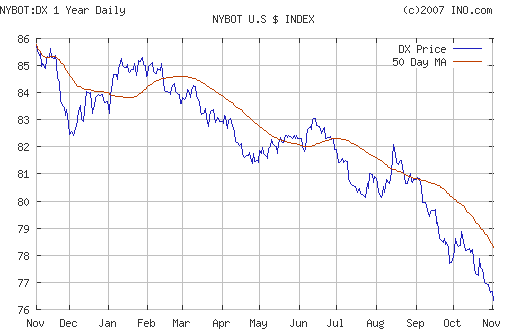

Roger Nusbaum argues -- correctly, in my view -- that with the dollar in free-fall, international exposure is more important than ever. In practice, how can investors "play" the falling dollar?

Move out of US stocks and into non-US stocks, closed-end funds and ETFs. The easiest way to do this is with ETFs...

...Buy foreign currencies or foreign bond funds. The easiest way to do this: The Rydex Euro Currency Trust (FXI). Or you could use closed end foreign bond funds, like Morgan Stanley Emerging Markets Debt (MSD), or the Aberdeen Asia Pacific Fund (FAX).

... Buy the gold and silver ETFs. Gold is widely regarded as a hedge against inflation and a refuge from a falling dollar. The gold ETF (GLD) and silver ETF (SLV) have both performed spectacularly, so there's a risk that they may pull back. (Look at what John Hussman just wrote on this.) Another candidate to consider: the Central Fund of Canada (CEF), a closed-end fund (yup, with the ticker CEF!) that has better tax treatment than GLD and SLV...

Dear readers, I would head on over to Seeking Alpha, and check out these suggested Exchange Traded Funds. You'd better believe that serious investors plot and scheme every day about how to make money, no matter if the market is up or down.

I suggest that you do the same. NOW is the time to protect your financial future. Those who are caught slipping are going to wake up one day in a WORLD of hurt.

(The US Dollar is Tanking...)

(...while the price of Gold is skyrocketing)

So what can you do to profit from this situation??

It's called shorting.

Once again, from Seeking Alpha:

Deutsche Bank and PowerShares announced the PowerShares DB U.S. Dollar Bullish (UUP) and the PowerShares U.S. Dollar Bearish (UDN) exchange traded funds which will list on the American Stock Exchange today.

David Hoffman of InvestmentNews reports these funds offer investors access to the Deutsche Bank Long U.S. Dollar Index and the Deutsche Bank Short U.S. Dollar Index, respectively. These indexes are managed by DB Commodity Services and are rules-based indexes composed of long or short U.S. dollar futures contracts. These futures contracts aim to replicate the performance of being long or short on the U.S. dollar against the following currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

A good overview of shorting (in the case of stocks, but applicable to most financial products,) can be found here.

So in conclusion, it's about high time to get your financial house in order, before we drown in hyperinflation and suffocate from the sky high tax and interest rate increases that will occur once our global credit card gets shut off.

It's been known to happen before. Anyone remember the Asian financial crisis?

Be safe, and keep your eyes open.

Kumo.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

10 comments:

ETF's are the worst. they don't even have the gold/silver. might as well buy the US dollar because it's just paper backed by nothing.

Only buy physical bullions and stocks from gold/silver mines.

Anon,

True it is always better to buy the gold directly, and hold it.

This particular fund (GLD) holds actual bullion, but not all of them do, so it's always best to check em out thoroughly, and talk to your adviser before jumping in.

I like ETFS because it's easier to get in and get out than say a futures or a forwards contract, not to mention that the price per share is a lot cheaper than the X dollars per ounce of gold bullion/coinage.

For the average investor, these particular ETFs are easy ways to play these latest trends.

But yes, it must be stressed that holding actual coinage is all the way IN!

Yeah ETF's are very convenient compared to actually buying coins but there are many downsides.

I really hope for you that the ETF your investing in actually does have the bullions..most of the ETF's are traps set by the elite for the stupid ignorant masses.

In the pretty soon comming economic collapse....how do you actually get to your coins? do you want to sell your ETF's for hyperinflated dollars? if you actually have the coins you can buy cheap real estate with your physical holdings.

Personally I recommend first having actual physical coins (and keeping your mouth shut about it) then something like an ETF IF You know that they acutally have the coins. and then a small percentage in gold/silver mines. mines are risky because they are only a piece of paper but they hold the most leverage.

Anon,

I'm with you when you're right... coins in my grubby little hands are the true failsafe just in case shit hits the fan for real.

However, in the meantime, I'm diversifying and hedging for the risk that things lurch on the way they are for a bit longer.

There's no telling when stuff is actually going to go down like I think it will... and so it's always a good idea to have investment vehicles that are easy in, easy out, and yet allow the opportunity to capture some (albeit fiat and inflationary) dollar earnings. Because, at least for the time being, federal reserve notes are a lot more liquid, and why waste my coinage just to go to Macdonald's?

In these days and times, I've really spread out my investments across a broad variety of classes, no more than 10-20% each per investment. And overall, ETFs fit my strategy nicely. Although as you say, many people won't read the fine print, and will get taken in by the sharks that call themselves investment brokers.

I like, more than anything, real stuff such as gold, real estate (like you suggested)... things along those lines. Because when it all goes down, paper money wealth is going to evaporate.

The masterplan is to eventually exchange all but a bare minimum of federal reserve notes into coinage (gold and silver), real estate, and other type goods, and only keep enough cash on hand to pay bills and that type of stuff.

Good points.

Kumo,

good post. I understand your point of view better now. The main difference is that you think the system will last longer than I think it does. And maybe you are right, you said it yourself we can't look exactly into the future.

but look at the US dollar index it's 76.02 ....look at gold 823.80, silver 15.49...look at the newspapers and shit even they are talking about inflation and buying gold. though they are not talking the whole truth of course.

the real inflation(as in growing money supply) figures are 10%+ for USD and 8%+ for Euros. Look at citigroup, UBS, Merrill Lynch and all the other banks losing billions of dollar. yeah the money men manipulate the shit out of the financial markets and maybe they can keep it up for a few more years but to me it looks like they are losing control and the system will probably collapse somewhere mid to late 2008. I might be wrong...but the problem with buying gold/silver last minute is that there probably won't be any available anymore. the elite and a couple of smart guys gonna have them all! people who are buying physical gold/silver are experiences shortages all the time...the demand is growing heavily but the supply ain't. where is the gold of the central banks?? probably all sold already to meet the demand and keep gold prices down!

anyway I wanted to thank you for your blog. your link to kyosaki talking about silver got shit rolling for me...and the more knowledge I gained the more I realized that the collapse of the west is comming sooner than I thought(I thought it was going to be one to two decades).

by the way an other alternative you might look into if you don't already know is digital gold currencies like goldmoney.com. It's kinda like an ETF with neat features...but in my opinion more trustworthy than ETF's. not saying that I fully trust goldmoney.com and the like though.

"By the way an other alternative you might look into if you don't already know is digital gold currencies like goldmoney.com. It's kinda like an ETF with neat features...but in my opinion more trustworthy than ETF's. not saying that I fully trust goldmoney.com and the like though."

Thanks for the tip! I will look into it, and give my comments on it at a later date.

"anyway I wanted to thank you for your blog. your link to kyosaki talking about silver got shit rolling for me...and the more knowledge I gained the more I realized that the collapse of the west is comming sooner than I thought(I thought it was going to be one to two decades)."

No worries friend... this is why I blog. I can't reach everyone, but I would feel terrible if I just went off and did my own thing and didn't tell a soul about what was coming.

I've known the true state of the government's finances since early 2006, when I got ahold of the Financial Report of the United States Goverment (linked on my sidebar) and read it for myself.

I've been slowly preparing ever since then, but things have been moving a lot faster than I had anticipated. I never expected that we could be looking at a MASSIVE US Dollar sell off so soon. I though such things would be a least another 3-5 years away. So in a way, we've both been caught by surprise.

"but the problem with buying gold/silver last minute is that there probably won't be any available anymore. the elite and a couple of smart guys gonna have them all! people who are buying physical gold/silver are experiences shortages all the time...the demand is growing heavily but the supply ain't. where is the gold of the central banks?? probably all sold already to meet the demand and keep gold prices down!"

Probably! Deepcaster (in his Juiced Numbers series) explains how the government has been manipulating the figures for years, including the price of gold, because our present system discourages an open and honest audit of our gold stores.

The papers are not going to say anything, because the Money Masters want the people to believe that everything is going to be aok. As for the Big Banks, these losses we've seen are only the beginning. Watch the Fed cut even more to bail them out.

I think that, this time, the Money Masters are either finished through their own idiocy... OR they are engineering the collapse of all collapses in order to wipe out the middle class once and for all. I'm not sure which, but as you read in Secrets of the Federal Reserve, these people use disasters to their own benifit.

It's not a case of financial suicide we might be facing here... I suspect it is premeditated murder.

One more thing. I try, as much as possible, to deal in truth, or truth as much as I can verify it, and not rumor.

But I will say this:

I've heard from a friend in the trading business that insiders HAVE ALREADY BEEN LIQUIDATING FOR AT LEAST TWO TO THREE YEARS PRIOR.

Quiet as kept.

I can't confirm this... but it sounds plausible.

So in any event, it might be time for you to inform your friends and loved ones, and prepare them for the worst.

Hope for the best, hedge for risk, try to profit on the downside because... a whole lot of people are banking on a meltdown.

HOWEVER!

On the bright side, feminism will be no more, if indeed our financial system crashes.

No government subsidies, no love.

Be easy.

Excellent commentary !

I would like to suggest that what is ideally needed is a return to a bi-metallic standard. That is gold and silver as monetary agents.

Long story short - the relationship between these two metals helps to keep their values and utilization harnessed in a more beneficial and truer way.

Due to the ongoing debacle in the banking sector and its spillover into brokerages etc. it is advisable to get your stocks in Certificates and hold them yourself.

A good tip concerning the physical holding of stock certificates!

I don't wanna come across as negative but if history tells us anything then that evil prevails and everything is planned so the financial collapse is planned to I suspect. On the other hand there are some good powers working in our universe too like Thomas Jefferson so maybe we will have a time of peace without feminism and bi-metallic standard?

On another note:

GOLD 843$

Silver 16$

USD INDEX 75.5

I GUESS IT'S TIME TO ESCAPE...lol yesterday i was posting about the collapse being late 2008 now I'm thinking more like next week`?

http://www.bloomberg.com/apps/news?pid=20601087&sid=aUYiisswPSJw&refer=home

china dumps us dollar

Post a Comment