I would like to wish you and yours a very happy Thanksgiving. Please keep in mind all of the blessings you have received thus far, and refresh and renew your spirits for the struggles that are sure to come.

First up,

I wanted to share this audio piece concerning Dr. Ron Paul. My distant relatives, the Israelis, discuss the Paul campaign, and shred any silly allegations of Paul being an Anti-Semite into very small kibbles and bits.

Me Likes!

Next topic,

The decline of the dollar.

I recommended a few posts ago that you should be EXECUTING your financial survival plans.

DON'T SLEEP. THE FINANCIAL SITUATION IS DETERIORATING RAPIDLY.

Consider:

1) As of yesterday, the S&P 500 has incurred a NET LOSS for 2007.

In other words, if you had tracked the S&P index, instead of going international, diversifying into Gold and Silver, shorting the U.S. dollar, or making some damn good domestic stock picks, you have lost EVERYTHING you earned this year.

2) Domestic investors who stayed only in U.S. assets may have actually lost money, EVEN IF THEY HAD POSITIVE RETURNS.

How can this be? you wonder.

According to Mr. Daughty of Goldseek.com:

"Suppose you put $500,000 into a money market account earning 4% a year back on November 7, 2002. Compounded daily, you'd have $610,694.69 as of yesterday."

Immediately I know that he and I travel in totally different circles, as all my hoodlum friends and me TOGETHER couldn't come up with $500,000 to put into some stinking money market fund. So I was getting ready to say "Bah!" and leave, when he says, "But wait! Over that same five years, the dollar has lost another 28% of its purchasing power. So, what one dollar bought in 2002, will only buy $0.72 worth of goods and services today."

At that, I start sensing something sinister and important here, but I know that I am too stupid to understand exactly what, so I will keep my mouth shut and my hand inching towards the pistol I have under my jacket, just in case. This "freezing like an armed deer in the headlights" tactic turned out to be very fortuitous, as he was somehow persuaded to go on to explain "So that $610,694.69 in savings that you accumulated and thought you protected so wisely in a money market fund? Well it will only purchase $439,700 worth of goods and services - 28% less than you thought!"

It's a frightening Twilight Zone moment when you realize that you started with $500,000 in buying power, and you ended up with, after waiting five long years, with only $439,700 in buying power! That's $60,300 LESS than what you started with!

And that is before you pay the capital gains/income taxes on the phantom "gains" on that additional $110, 694.69 in account value, turning your total real loss in buying power into a bigger, much bigger net loss! Hahahaha! Ugh.

That pretty much sums it up, Ladies and Gents.

The U.S. dollar, and the American economy, is going DOWN. It can't be helped at this point. There ain't Shit the Fed can do to stop it either.

What you MUST do, after consulting with your financial adviser, is to execute your wealth preservation strategy.

For example, you'll remember that I posted about gold ETFS (exchange traded funds) and ETFs that are shorting the U.S. Dollar.

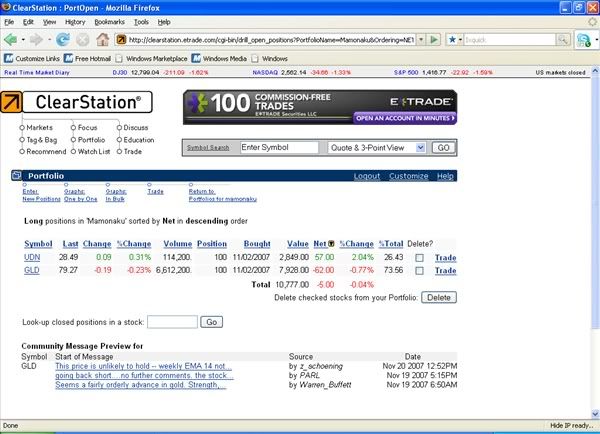

Well friends, if you had bought shares in GLD and UDN, this is how you would be doing:

(The performance of GLD (Gold) and UDN (Dollar Short) as of 11-21-07).

As you can see, the Gold ETF is more volatile, while the Dollar Short ETF has so far produced respectable returns thus far. I anticipate that Gold will break out of it's downturn and resume it's upward climb next month, while the Dollar will consistently lose value, hence increasing my overall rate of return.

And, while my overall performance is negative, I am willing to wait for the price of Gold to take off once again. She's just taking a breather, as the fundamentals of the U.S. Economy are steadily worsening. A great deal of people will literally jump on the Golden bandwagon before the end.

In this game, Patience is a virtue, and dips in price are buying opportunities. Just remember though, talk to your financial adviser first before making any power-moves.

And finally,

In addition to financial products, you should also be acquiring hard assets, such as Gold and Silver, and it's really easy to do. Mr. Robert Kiyosaki gives his reasons as to why you want precious metals in your portfolio [A]. It's worth the read!

So how do you go about getting out of the Dollar and into something that is actually worth something??

It's really simple.

A) Pick up your phone book

B) Look up "Coin Shop" or "Coin Dealer"

C) Call and speak with the proprietor

D) Ask about his Gold/Silver inventory

E) Visit the shop and pick out the Gold/Silver ingots/coins that are in your price range. You can buy an ounce of Silver for a nice price. For example, I bought Silver on 11-20 for $15.05 per ounce, plus tax.

In addition, you can buy coins in multiple sizes and prices. But in general, to avoid overpaying for your metals purchases, try to buy the biggest amount of Gold/Silver that you can per transaction.

For example, it's better to buy one 100 ounce coin than to buy ten 10 ounce coins.

F) Make the buy, and sleep better at night knowing that you have converted your worthless fiat pieces of paper into something that has withstood the test of time.

G) Don't overdo it though. You will still need Cash to pay the bills, buy groceries, and so forth. Most professionals recommend that you have 10-20% of your assets in Metals. I would say that under the circumstances, you want to make sure you have enough Cash on hand to take care of your business and play around in the Financial Markets. Take the rest of your dough and get your Gold and Silver on!

(Special note: Once you obtain enough riches and plunder, I would recommend that you put your earnings to work for you. Please watch the videos below to learn more.)

Aiight??

Ya'll have a nice day.

Kumo out.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

No comments:

Post a Comment